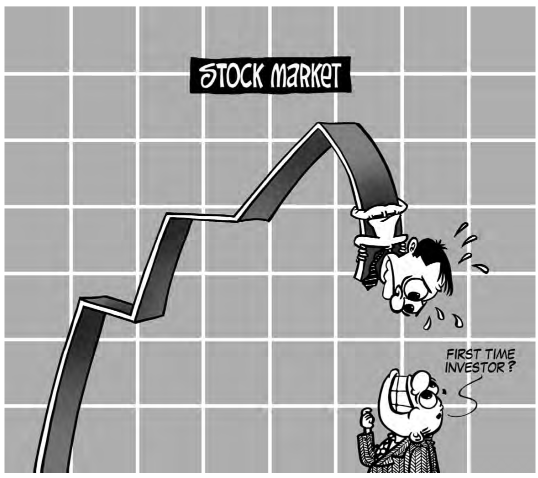

I have often said this in my seminars – “Many of us want to invest but a few of us are NOT prepared to be investors.”

The common question amongst investors is often ‘how much are making? ’True – profits are after all the benchmark we set for a successful investment plan. However, many often choose to forget that in the process of seeking for profits, there will be times of unrealized losses and times of unfavorable returns due to events beyond anyone’s control. Even if it is an event which one tries to predict, many forget that such events are just temporary and not catastrophic where total and irrecoverable loss cannot

happen. The test of a successful investor is when the ‘rubber hits the road’ – when you are faced with an unrealized loss position, can you prevent yourself from reacting and allowing fear to push you to the edge and force you to sell your positions?

Fear is a common emotion in our lives and in many instances, fear protects us from danger as in a fight or flight situation. However, as investors fear may be more punishing than protective because it prepares us to react and changes our perspective of the external events. The acronym F.E.A.R. stands for “False Evidences Appearing Real” because fear deletes, distorts and generalizes events which may are not as adverse as they seem to be or as we perceive them

It is no wonder that Warren Buffet is one of most successful investors in the world. He practises “inactivity” as an investor. Instead of reacting to fear, Warren Buffet says that investors should learn to be calm and remian inactive in times of uncertainty. His thoughts are best summed up in four of his famous wise quotes.

- ‘The Stock Market is designed to transfer money from the Active to the Patient’ investor.

- ‘Stop trying to predict the direction of the stock market, the economy, interest rates, or elections.’

- ‘I never attempt to make money on the stock market. I buy on the assumption that they could close the market the next day and not reopen it for ten years.’

- ‘My success can be attributed to inactivity. Most investors cannot resist the temptation to constantly buy and sell.’