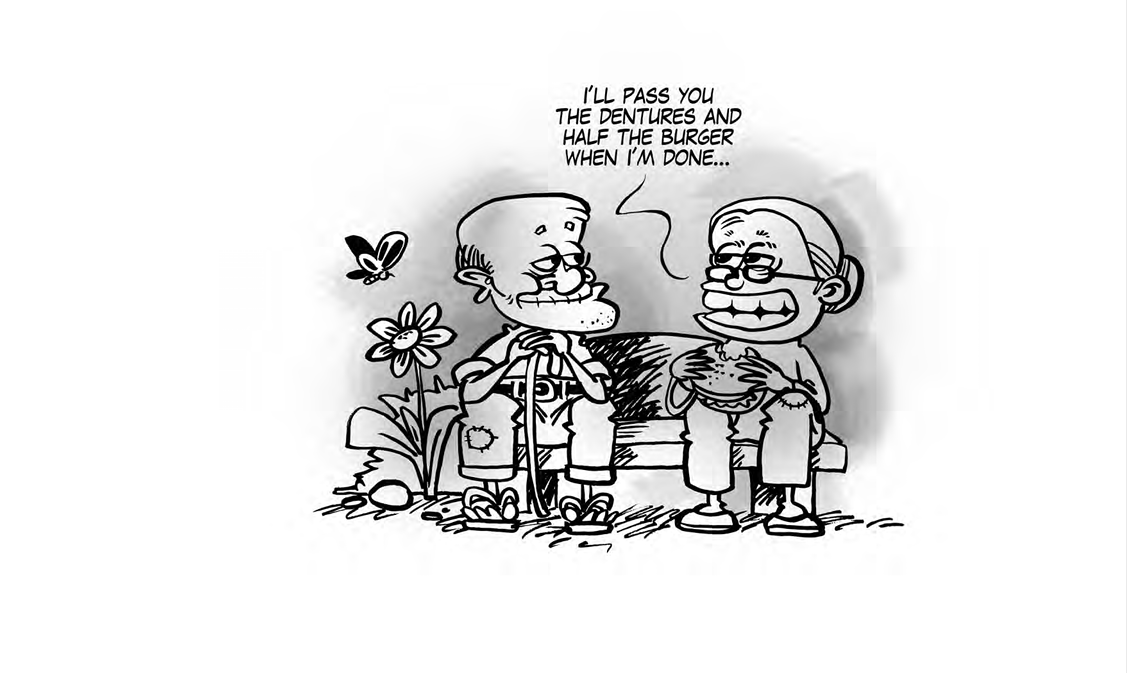

“Time, time…..wherefore art thou?”…….Is this going to be the lament in your golden years? How often have we ignored or dismissed the advice of our parents to save for our old age?

Let us look at the research conducted by The TransAmerica Center for Retirement Studies, which found that a delay of just two years in starting to save for your retirement shaves off a remarkable 15% of your retirement nest egg over the life of an average career. An illustration drives home the point further.

Joe starts saving RM5,000 a year for his retirement nest egg at 28, whereas Jane begins at 30. Assuming they both make a 7% return on their savings, at 65, Joe will have RM801,687 while Jane will only have RM691,184!

Their studies have also emphasized that not only are many largely unprepared for retirement but that relatively few have a backup plan in the event they are forced into retirement earlier than planned.

What can you do to increase your confidence in ensuring economic security in your golden years? Don’t just worry about your financial future; take action to rebuild some measure of a secure retirement, and increase your level of preparedness by taking an interest in your finances. Take the following steps:

- Start a saving habit

- Increase your financial literacy with easy-to-understand educational material, and talk about it to raise awareness

- Set goals, determine how much you need

- Take decisive measures and strategize

- Seek advice from professionals

Learn to take on more risk with investments, as leaving all your money in cash will not help in combating the ravaging impact of inflation in the long term; learn about the power of compounding, diversification, asset allocation, and building up an investment portfolio.

Most of all, start when time is your adversary, not your foe; decide to put aside a fixed percentage of your income towards your retirement nest egg to prevent resorting to catch-up contributions at a later age.

It is now or never, as the song goes. My advice is to START NOW!