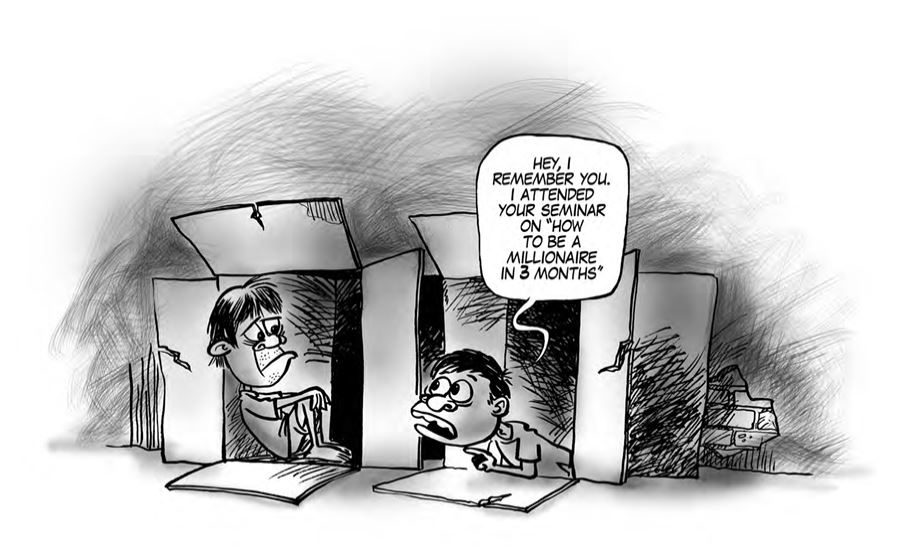

Someone once told me this: “The desire to be rich is human but to get there quickly is divine”. In a world where instant gratification thrives, getting rich quickly removes all the hard work and time required in acquiring wealth. But when a scheme promises you the sky, it may eventually spell more headache for you than imagined. But then, how do you spot a scheme that spells trouble?

When it sounds too good to be true

When a proposal seems too good to be true, it really isn’t. A guaranteed return of anything more than a risk-free rate should raise a flag for you. The catch word is “guaranteed” as no one can guarantee you any return besides published FD & saving rates.

When it is not sustainable

Sustainability is based on fundamentals. For example, if a proposal tells you that there is no downside or bad times, the fundamental basis of demand and supply has been violated.

When it has a short incubation period

A proposal that promises returns in a short period of time should raise a red flag. “Short” is generally considered as anything less than one year. An investment scheme or a business needs to have a relatively acceptable incubation period. Promises of returns within a few months must be questioned as to how that can be derived.

When your gut feel says “stop”

Greed is part of being human. But there is a part of our subconscious mind that protects us from being hurt – that is our gut feel. When you hear that little voice saying “stop”, listen to it. Tune out the excitement and stop the rush to get into such schemes.

There are essentially no get rich quick schemes that work but there are certainly slow ones that do. When you get your financial life reorganized, identify where you are wasting your money and then get the right money management strategies to work for you, getting rich slowly may not be that slow after all. Patience pays. Greed punishes.