What has a cup of coffee made with espresso and steamed milk got to do with your finances? Actually NOTHING. However, I want to introduce you the “Latte Factor” which has everything to do with your finances! The “Latte Factor” is based on an extremely simple concept – we need to look at the small […]

Author Archives: Mun Wai

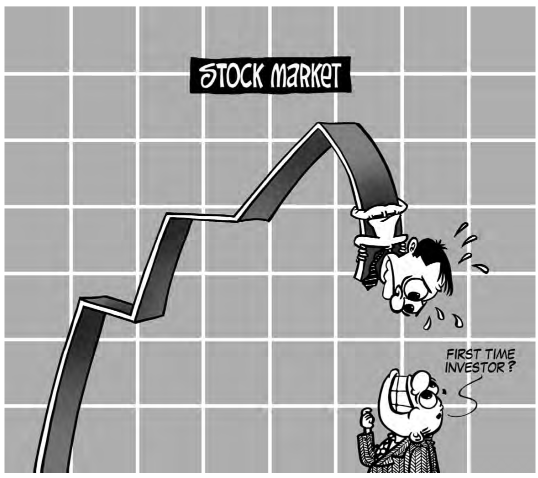

I have often said this in my seminars – “Many of us want to invest but a few of us are NOT prepared to be investors.” The common question amongst investors is often ‘how much are making? ’True – profits are after all the benchmark we set for a successful investment plan. However, many often […]

A will is a written document which states your last instructions of how and to whom your assets should be distributed after we have kicked the bucket. Drawing up a will can be easy so long as you include the important components of a will. It does not have to be stamped unlike other legal […]

According to a new report by the Psychological Science Journal, how much you are respected bythose around you contributes more to your overall happiness than the contents of your bankaccount. The researchers believe that money may not necessarily buy you happiness because weadjust to new levels of wealth, making happiness derived from money, transient. […]

It’s already a few months into the new year, and many of us can already see our financial resolutions starting to fall by the wayside. This seems to happen every year, so why do we keep setting these financial goals? Financial goals can be extremely effective, depending on how people set and approach them. They […]

Imagine if you had a time machine that allows you to travel back in time and travel back again to the future, what financial decisions would you change for the better? Surely, there would be useful lessons from the past. One observation from the past would obviously be how cheap everything used to be and […]

When you build a house, you need a good foundation to protect you from range of circumstances. Insurance protection does the same. It is the “foundation” of the plan. Do we protect what we have built for those we love? In financial planning, we divide risk management into several main areas: Property and Casualty Insurance, […]

Cash is King, so they say. True. But how do we make CASH KING? What are the simple fundamentals when it comes to dealing with cash? Here’s a simple way to teach us using the K.A.S.H. acronym. K-nowledge: Know where and when our money is coming from and going out to. It’s a task that’s […]

Have you ever denied yourself or a loved one of a branded outfit, an imported toy or expensive fine dining just because you think you shouldn’t be spending that kind of money? Are you still unsure if you can afford to upgrade your home or change your old junk to a better car? Financial freedom […]

For the average investor, unit trust is one of the common investment options used to meet their financial milestones. Check out these 5 key takeaways before you invest in unit trust: Do Your Homework: Make an effort to comprehend the fund factsheets before finalizing your selection. At the least, make time to understand the underlying […]

- 1

- 2